Loan apps in Nigeria are easing financial stress and helping a lot of Nigerians live a better life. In light of the prevailing economic conditions nationwide, numerous Nigerians are resorting to seeking financial assistance through online loan applications.

In this article, we review the top 20 loan apps in Nigeria, with links to the application process.

Loan Apps In Nigeria

FairMoney

FairMoney Microfinance Bank is Nigeria’s number 1 most downloaded fintech app. With over 10,000 loan disbursements daily, and over 5 million customers enjoying banking, savings, and investment services,

You can access Fairmoney’s personal loans and business loans or improve your savings with the FairLock or the FairSave features, all of which can be accessed through the Fairmoney application on Google Playstore.

Palmcredit

PalmCredit is a virtual credit card in Nigeria that makes it easy for customers to access loans anytime and anywhere. It offers users loans of up to ₦100,000 within minutes when they register on their mobile phones. Loans range from ₦2,500 to ₦100,000 and loan term duration ranges from 12 – 26 weeks.

Palmcredit boasts of low interest rates and high loan amounts as well as quick disbursements and flexible repayment. Users can easily access loans from Palmcredit by downloading the mobile application from Google Playstore or Apple App Store.

Branch

Branch uses alternative data to offer financial products that people can access anywhere in Nigeria, by analyzing smartphone data to determine loan eligibility, with permission from their customers. With Branch, clients can attain financial access even with limited or no credit history or savings.

To access Branch loans, all you have to do is:

- Download the Branch mobile app

- Create an account

- Apply for the loan that suits your needs

- Receive the loan into your bank account.

Carbon (formerly Paylater)

Carbon makes access to loans simple and easy. No guarantors, collaterals or long forms are required. Apply for a loan any time of the day and receive funds in your Carbon account instantly. You get higher loan amounts and lower interest rates when you repay loans on time. The app also provides other functions and features like a regular banking app.

You can download the Carbon mobile app on Android or iPhone to access their loans.

Renmoney

A fintech company founded in 2012 and operating on a microfinance banking license in Nigeria. Providing loans, savings and deposit facilities to clients, Renmoney has earned the trust of many Nigerians. Also, customers are eligible to get up to ₦6m loan depending on their credit record and overall financial and employment status. Find out more on Renmoney webpage or download the mobile app on Google Playstore.

Specta by Sterling Bank

An online money lending platform that gives you loans of up to 5 million Naira in one transaction and within a few minutes. With Specta, you are eligible to get a personal loan or a business loan, as well as buy and pay later with the PayWithSpecta feature. To read more about Specta loans as well as apply for one, visit the website by clicking here.

Aella Credit

A digital lending platform founded in late 2015 by Akin Jones (CEO) and Akanbi Wale (CTO) in Lagos, Nigeria, offers instant loans to individuals and small businesses. It offers loan facilities to individuals and companies, with its main focus on Nigeria and the Philippines. Clients can apply for loans ranging from ₦2,000 to ₦1m, as well as get a repayment period of up to three (3) months. Aella Credit is also approved by the Central Bank of Nigeria (CBN). Aella Credit application is available on Google Playstore and Apple App Store and can be downloaded on your mobile devices.

QuickCheck

QuickCheck loan app is a Nigerian lending platform that provides fast and flexible loans to customers. According to the app, users can access quick loans of up to ₦30,000 without collateral for 15 to 30 days.

QuickCheck, owned and managed by Arve Nigeria Limited, offers a convenient solution for individuals in need of rapid financial aid, with a maximum loan amount of NGN200,000.

VULTe (By Polaris Bank)

With VULTe, clients have the opportunity to apply for diverse loans, including term loans for business expansion, overdrafts to address business emergencies, auto loans for personal vehicle acquisitions, salary advance loans tailored for employed individuals, and also Lite loans catering to personal needs.

VULTe stands as a digital banking service provided by Polaris Bank, catering to individuals and small to medium-sized enterprises by offering a diverse array of products and features to enhance their banking experience.

ALAT (By Wema Bank)

To be eligible for an Alat loan, you need to possess an Alat standard savings account, an upgraded profile, as well as a track record of credit and debit transactions within your Alat account.

Alat, which is owned by Wema Bank, functions as a digital bank in Nigeria, providing users with access to a range of financial services including loans, savings, transfers, and payments, alongside physical and virtual cards.

The platform offers loans of up to ₦2,000,000 as well as an interest rate of 2% per month on a reducing balance basis.

Zedvance

Zedvance loans stand out due to their swift disbursement times and adaptable packages suitable for a diverse range of individuals. Nevertheless, the loan application process may be a bit complex, and it is worth noting that the company’s offices are presently located solely in Lagos. Zedvance offers loan packages to a variety of individuals, including non-salary earners, petty traders, and salary earners in both public and private sectors.

Users can access the Zedvance loan app on Google Playstore or Apple App Store.

Kiakia

Kiakia Financial Institution, established in 2016, is a licensed non-banking institution founded by Chimeziem Anyadike and Olajide Abiola. With Kiakia loans, clients are offered a straightforward, swift, and dependable borrowing experience; however, they come with high-interest rates and a shorter repayment period. These loans range from ₦10,000 to ₦200,000, catering specifically to individuals seeking quick access to funds in hopes of prompt repayment.

Click here to download the mobile app.

Quickteller

Quickteller provides loan services to customers in Nigeria, allowing them to apply through different channels such as USSD, the Quickteller mobile app, or the website. The eligibility of a first-time customer for a loan may be dependent on their credit history and transaction record, influencing the approved loan amount. Furthermore, the loans have an interest rate that ranges from 3% to 15%, accompanied by a repayment window extending from 10 days to 3 months.

Loans can be obtained through the Quickteller mobile app, website or via USSD Code (*723#).

Page Financials

With over six (6) years of experience, Page Financials provides quick loans, investment options, and easy payment solutions to meet basic financial needs. The company assures easy loans with uncomplicated repayment terms, transparent rates, and no hidden fees. Also, loan options are accessible for periods ranging from 3 to 12 months, and customers can receive the funds in under 3 hours. Apart from providing loans, Page Financials offers investment opportunities for customers seeking to achieve greater returns.

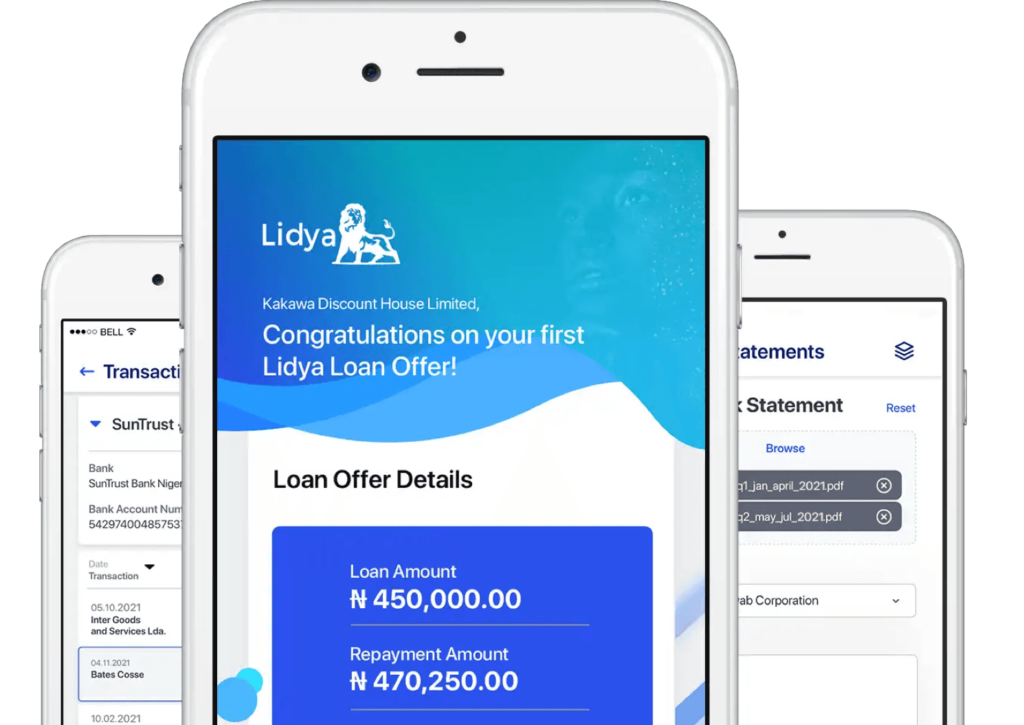

Lidya

Lidya, established in 2016 by Co-Founder & CEO Tunde Kehinde, is a fintech company reshaping Nigeria’s lending environment. It specializes in granting small and medium-sized businesses access to finance and has emerged as the premier digital financier for SMEs in Nigeria. Furthermore, the company operates with teams located in Portugal and the US.

Through Lidya’s Finance-on-Demand platform, entrepreneurs/business owners can quickly obtain operational loans to settle invoices, pay suppliers, as well as foster business expansion.

The uncomplicated application process, which typically takes around 15 minutes, in addition to the option to securely link their bank accounts for seamless data sharing, empowers business owners to access Finance-on-Demand in a few simple steps.

Kredi

Kredi provides a variety of loan options, such as Nano Loans, SME Loans, and Kredi-SympliFi Loans. With SME Loans, customers have the flexibility to access emergency cash of up to ₦100,000, while Nano Loans allow for quick access to up to ₦50,000.

The Kredi-SympliFi Loan, characterized by its low-interest rates, ensures swift access to instant cash, reaching up to ₦50,000, with support from friends or family residing abroad.

Beyond loans, Kredi provides savings plans like Daily Flex as well as Bill Payment options for airtime, DSTV, and GOTV. Utilizing the Kredi POS app, customers can transform into agents, enabling them to enhance their income monthly, no matter their location.

EaseMoni

Easemoni, a Nigerian loan service provider, grants its customers quick and convenient loan applications through its mobile app. With the app, users can easily apply for loans without collateral, and approval is granted within 10 minutes of submission. Easemoni offers loans of up to N1,000,000 to both new and existing users. Regular usage of the app, coupled with timely loan repayments, empowers users to enhance their credit scores.

To enrol in Easemoni, individuals simply need to download and install the mobile app, input their essential details, and initiate the loan application process.

SokoLoan

This is one of the loan apps in Nigeria that offers interest rates ranging from 4.5% to 35%, and loan repayments are automatically debited from the linked bank account on the agreed-upon date.

GroFin

GroFin offers financing solutions for small and medium-sized enterprises (SMEs) to address their growth requirements, accompanied by value-added business support aimed at assisting entrepreneurs in overcoming challenges associated with business expansion.

Creditville

One of the loan apps in Nigeria that leverages digital technologies and innovations to replace conventional banking and financial services. Creditville crafts the loan application to serve borrowers seeking financial access and facing challenges with traditional financial institutions. The platform provides loans spanning from ₦100,000 to ₦6,000,000, featuring a repayment period ranging from 3 to 12 months.

The interest rates for Creditville loans vary based on factors such as the loan amount, repayment duration, and the borrower’s credit score. These rates span from 6% to 31%. Additionally, the company imposes a one-time processing fee of 5% on each loan.

Note that all of these loan apps in Nigeria are downloadable from Google Playstore and Apple App Store. Visit their websites to learn more about the loan offers and how to apply.

Read also, How to Borrow Money From OPay

You may also like...

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments