To borrow money from Opay is easy and quite convenient, the first thing you need is a good credit score.

Opay was founded by Opera Norway AS Group in 2018, with its headquarters in Lagos. It is a mobile-based platform for loans, savings, transfers and other essential financial services for every individual.

OPay has over 35+ million registered app users and about 500,000 agents across Nigeria who rely on her services to send and receive money, pay bills and lots more.

OKash is Opay’s lending platform, powered by Blue Ridge Microfinance Bank, which customers can borrow money from. So how do you borrow money from Opay? Follow these easy steps listed below.

How To Borrow Money from OKash

- First download the OKash mobile app from Google Playstore

- Create an account and register for the Okash loan by providing all necessary information

- Log in with your newly created login details after creating an account

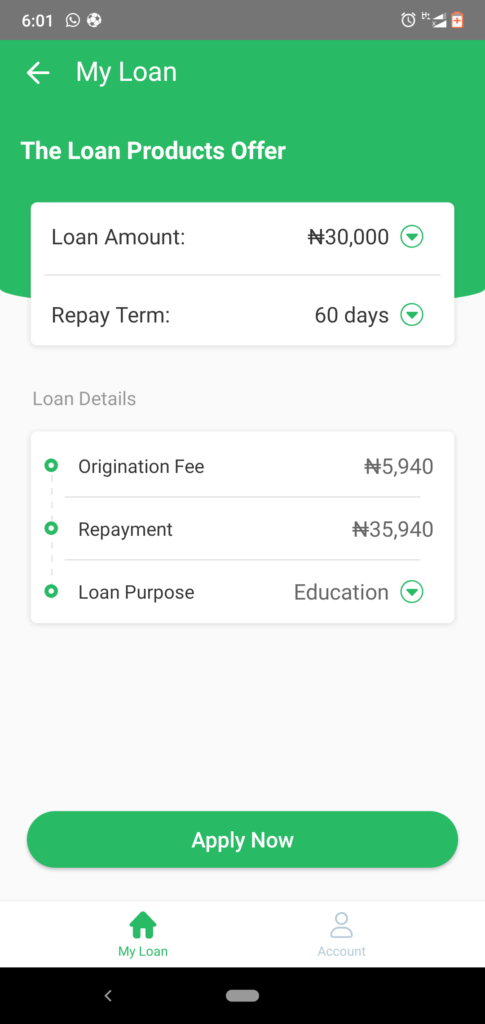

- Select your preferred loan amount from the displayed limits

- Choose loan duration and click on “apply”

- Wait a few minutes as the system reviews your loan request, and a notification will pop up.

- After reviewing, Opay will disburse the loan into your Opay wallet, which can then be transferred into a bank account.

Requirements For OKash Loan

- Bank details( account number, account name)

- Valid ID

- ID Photo (usually a selfie in-app)

- BVN

- Age range of 20- 55 years

- Proof of Monthly Income

- Complete Okash application

How to Repay Okash Loans

To repay a loan before the due date, follow the process below:

- Download the Okash loan app

- Open the Okash app on your phone

- Log into your account

- Click on the “repayment” option

- Fill in all required details

- Double-check to ensure that all details are correct

- Then, select the “repay” option

- You will receive an alert confirming the successful repayment of your loan.

Note that OKash will automatically deduct your loan amount from your bank account on the due date.

Also read, How To Get Migo Loan

You may also like...

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments